Mini-Budget increases Stamp Duty threshold

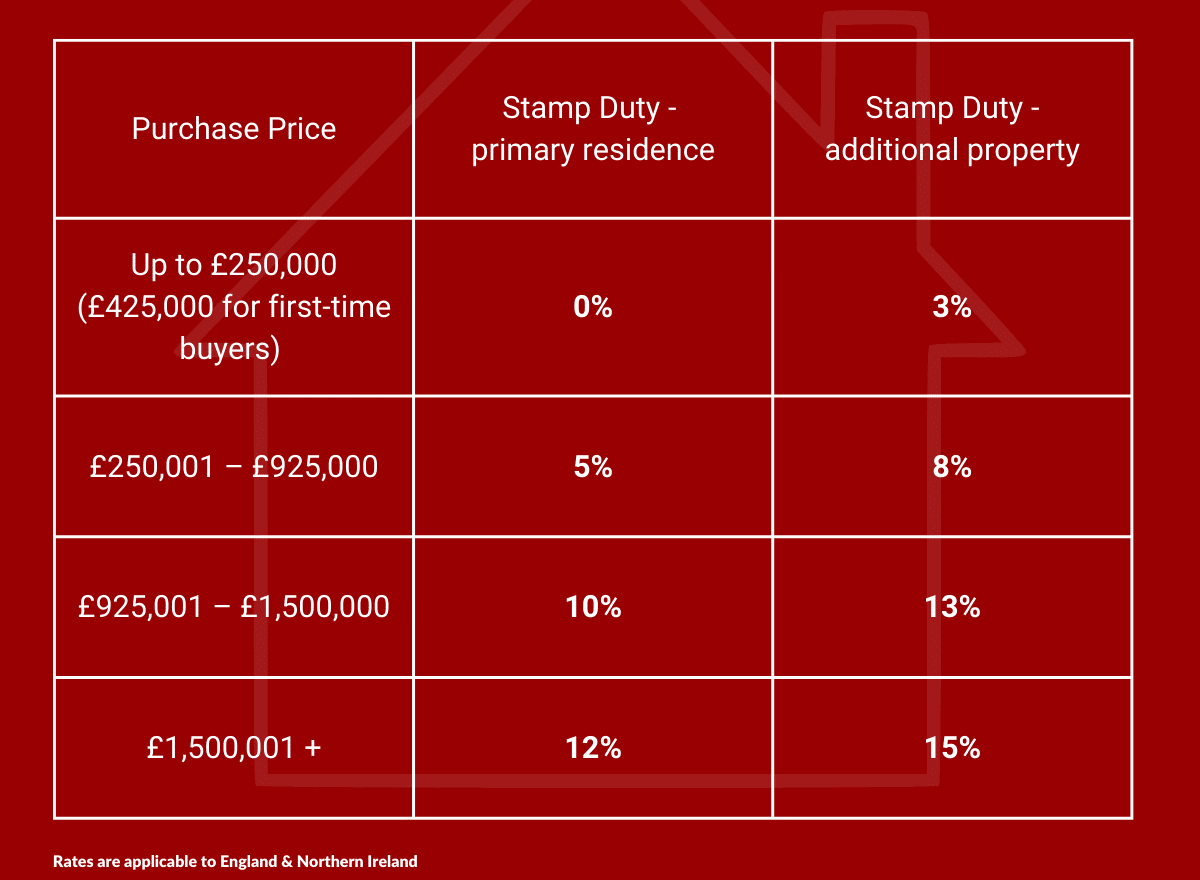

The Chancellor’s announcement today, as part of the mini-Budget, that he is increasing the threshold at which stamp duty is payable to £250,000 (£425,000 for first-time buyers) is welcome news for homebuyers and for the economy, but it also brings opportunity for our property investor clients.

The changes mean that home buyers in England and Northern Ireland will not pay stamp duty on property purchases up to £250,000 and, whilst the 3% surcharge for additional properties remains in place, it does mean that the cost of purchasing an investment property will reduce.

Sarah Woolf comments: ‘Whilst today’s news is to be welcomed, it does remain in the shadow of increased mortgage rates which may mitigate any saving made. This is the perfect time for our investors to make their move and for portfolio landlords to look to expand their portfolio.’

Looking to calculate how much stamp duty would be due on your next investment? https://www.moneysavingexpert.com/mortgages/stamp-duty/

Please call the Sterling Commercial Finance Team to get the best help and advice for your property needs on 0115 9849800 or email property@sterlingcommercialfinance.co.uk

This site covers Business Finance and Property Finance. Visit Sterling Capital Reserve for our Corporate Finance services