We're thrilled to introduce our innovative tool that searches over 90+ lenders for you. Get personalised property finance quotes that match your business's unique needs.

We have seen increased requests for short-term funding to support refurbishment projects. Several of these projects have been where a client wants to convert a property into a “house in multiple occupation” (HMO), which may be occupied by students, young professionals or individuals.

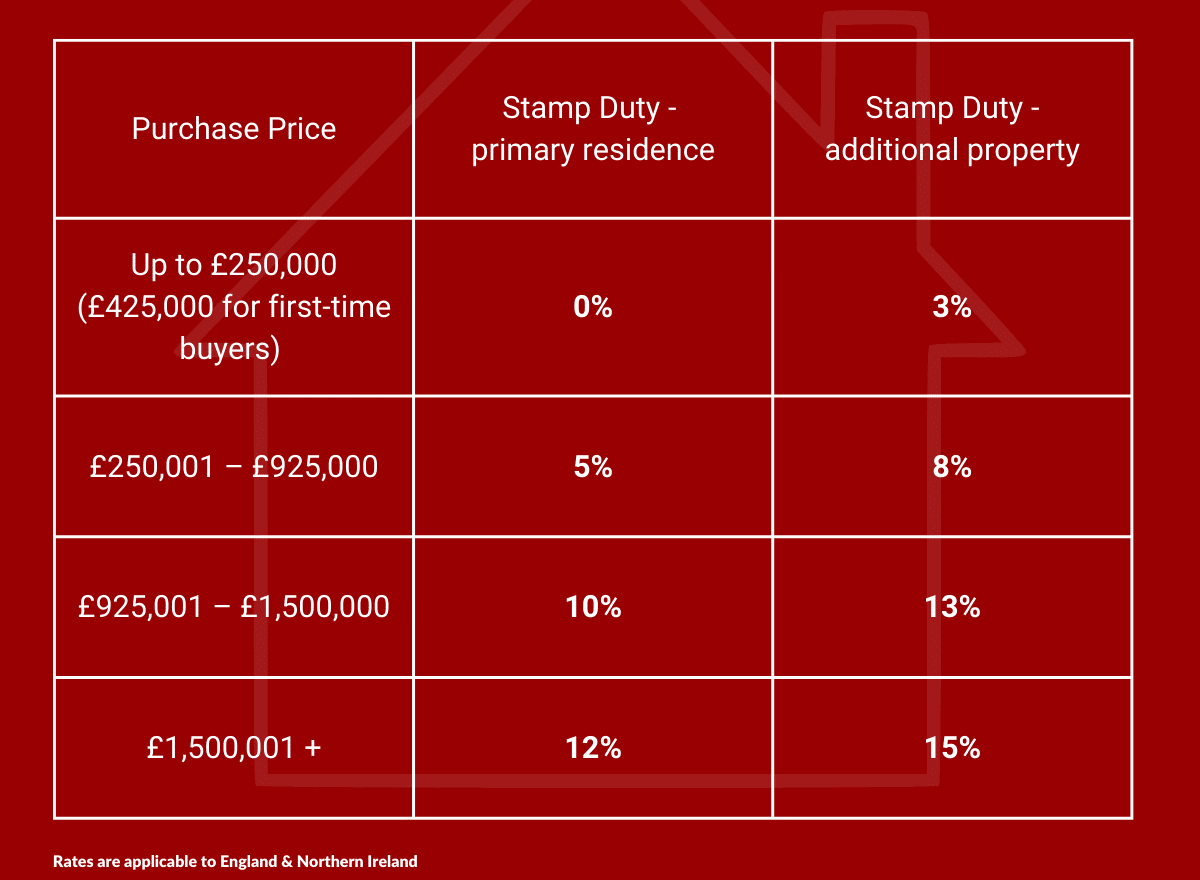

The Chancellor’s announcement today, as part of the mini-Budget, that he is increasing the threshold at which stamp duty is payable to £250,000 (£425,000 for first-time buyers) is welcome news for homebuyers and for the economy, but it also brings opportunity for our property investor clients.

We would like to invite all our friends and contacts to join us and enjoy some friendly rivalry throughout the season.

With such a wide choice of Lending options available to you, a Commercial Finance Broker’s role is to understand your requirements and to source, the most appropriate funding for your business or property finance need, saving you time and money.

Property development as an industry has grown considerably over the past 10 years with more and more people entering the market

Read Nic's latest Article in Business Link magazine about Commercial Property Landlords - are you ready for the EPC changes?

Read Nic's latest Article in Business Link magazine about Buy to Let Going Green

Last week I took the opportunity to have a Ramble with Mo from Tuscan Capital and we met at Markeaton Park in Derby

I recently caught up with Jo from Close Property Finance for a cracking stroll through Wollaton Park. We discussed all manner of things including the Deer Rut...