The Growth Guarantee Scheme (GGS) is a UK government initiative to boost small and medium-sized enterprises (SMEs) lending. Through this scheme, the government provides a 70% guarantee to lenders on loans extended to eligible businesses.

There are several ways of funding or financing a business, and the options available will depend on your business's stage, financial situation, and goals

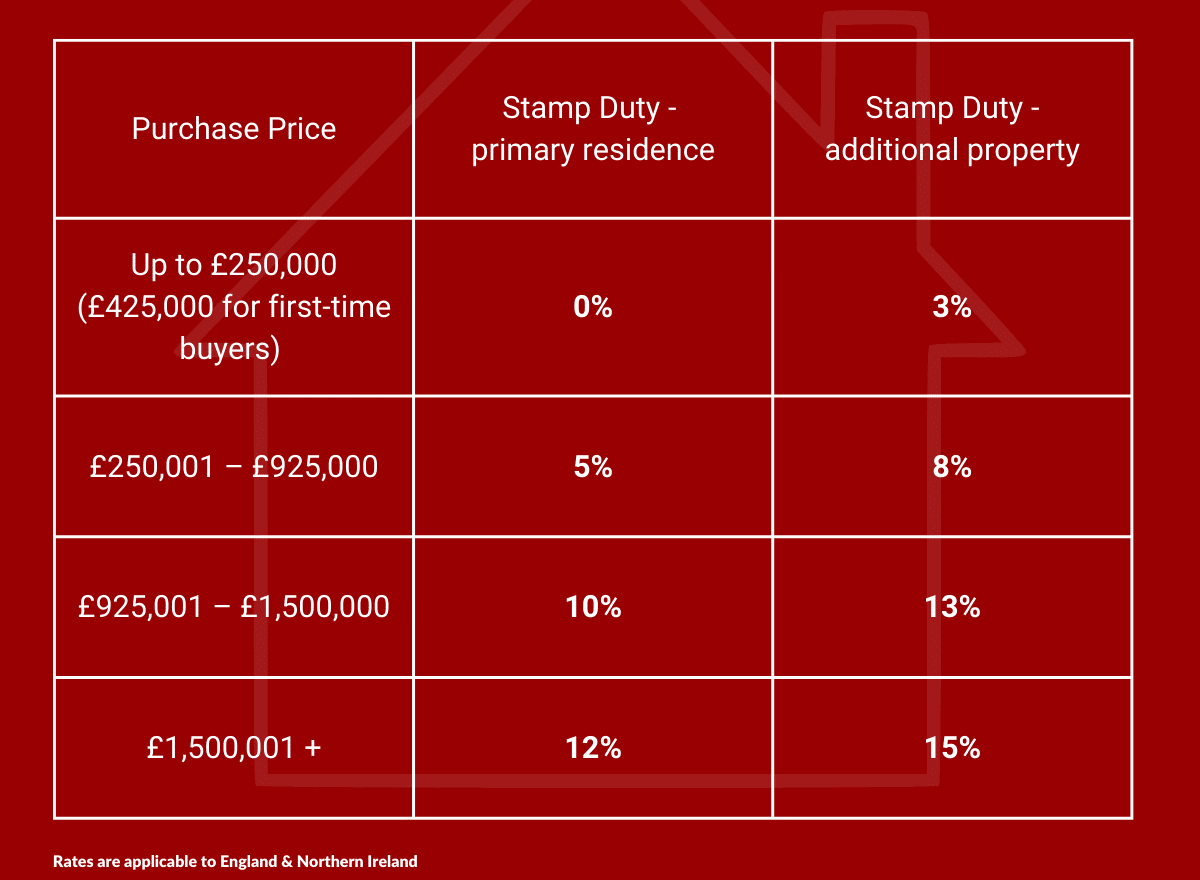

The Chancellor’s announcement today, as part of the mini-Budget, that he is increasing the threshold at which stamp duty is payable to £250,000 (£425,000 for first-time buyers) is welcome news for homebuyers and for the economy, but it also brings opportunity for our property investor clients.

We would like to invite all our friends and contacts to join us and enjoy some friendly rivalry throughout the season.

With such a wide choice of Lending options available to you, a Commercial Finance Broker’s role is to understand your requirements and to source, the most appropriate funding for your business or property finance need, saving you time and money.

Property development as an industry has grown considerably over the past 10 years with more and more people entering the market

Nick brings over 20 years’ experience in banking having worked at HSBC, 15 of which have been in Commercial Banking supporting local businesses and professionals

Matt Lobb, Commercial Financier at Sterling Commercial Finance is jubilant to have recently completed a six-figure working capital facility to support the growth plans of a market-leading environmental services consultancy

One of the recent evolutions has been the launch of green BTL mortgages by a number of Lenders.

Last week, I found out that Buy-to-Let (BTL) mortgages were 25 years old in September, having been created back in 1996.