The Growth Guarantee Scheme (GGS) is a UK government initiative to boost small and medium-sized enterprises (SMEs) lending. Through this scheme, the government provides a 70% guarantee to lenders on loans extended to eligible businesses.

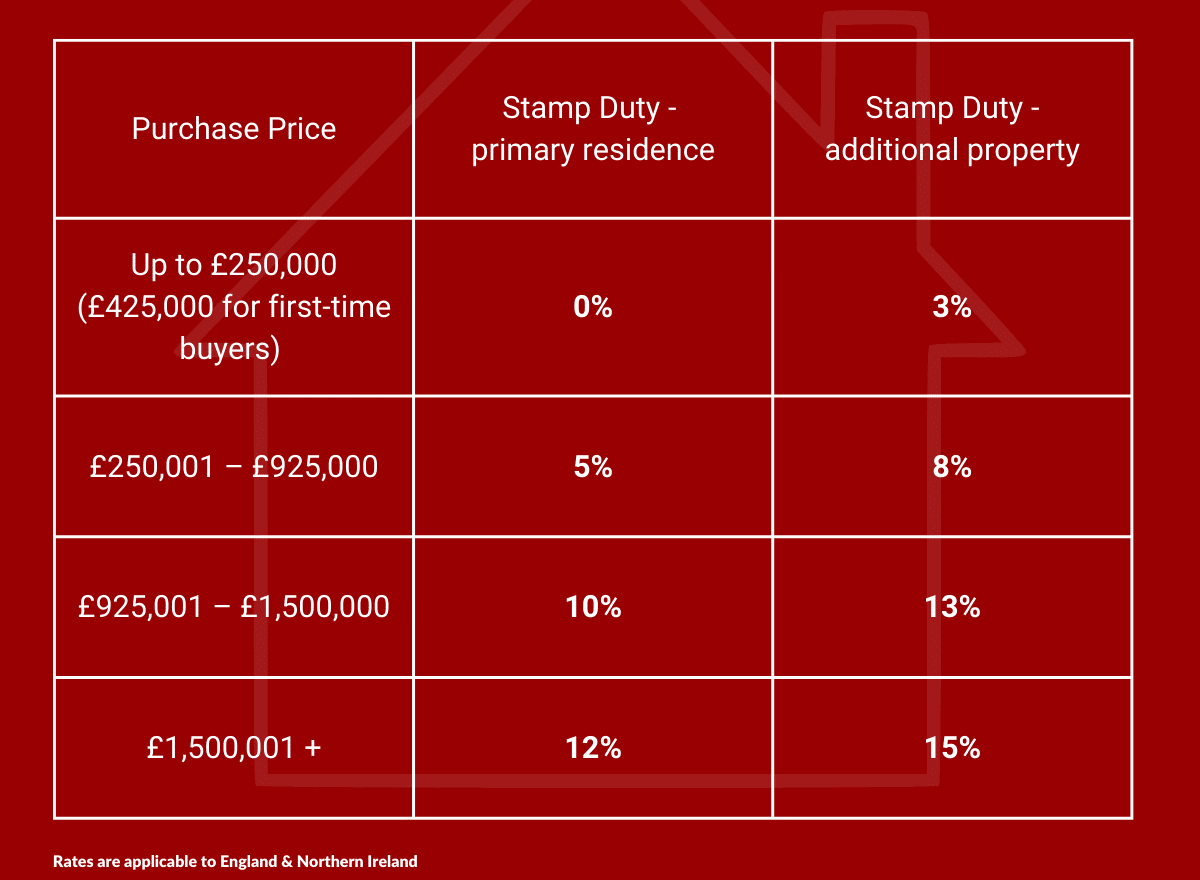

The Chancellor’s announcement today, as part of the mini-Budget, that he is increasing the threshold at which stamp duty is payable to £250,000 (£425,000 for first-time buyers) is welcome news for homebuyers and for the economy, but it also brings opportunity for our property investor clients.

Between the British Business Bank and the various Lenders involved, it has taken far longer than CBILS for some Lenders to be fully operational with RLS. However, while back in April there were only eighteen accredited Lenders to the scheme, there are now over seventy.

The British Business Bank Recovery Loan Scheme was launched this week as the replacement Government backed lending scheme to succeed the various Coronavirus Loan Schemes. However be aware options are limited just now.

The new Recovery Loan can in principle be used more widely and is potentially more flexible. However, much will depend on how the accredited lenders choose to operate the scheme within their own parameters and no doubt the devil will be in the detail.

So, like so many others running a business, you are facing a seemingly impossible challenge. The payments previously deferred (including March 2020 VAT) will shortly become due, CBIL’s/BBL’s repayments start soon, landlord’s patience has run out, customers are slow to pay/suppliers are about to stop supplying, wages are due at the end of the month and the bank balance is perilously close to the overdraft limit.

The British Business Bank has announced that the deadline for applications for these loan schemes has been extended from 30th November to 31st January 2021.

Be mindful not to clear loans in haste, only to find funding difficult to secure on similar terms, or worse unavailable, in the future.

The closing date for CBILS is currently 30th September 2020, but it would be foolish to leave submitting an application until then.

The Chancellor’s announcement that he is increasing the stamp duty threshold to £500,000 until 31 March 2021 is welcome news for the homebuyers and for the economy, but it is also brings opportunity for our property investor clients.